So, how many flip flops does the company need to sell to breakeven on its advertising expense?įirst, look at fixed costs. They rise when you increase production and fall when you decrease it.) The fixed costs to advertise the flip flops are $2,000. (Note: variable costs are per unit costs that vary depending on a company’s production volume. The variable costs to make each pair of flip flops are $14.00. The company sells each pair of flip flops for $24.00. Take this example of a company that sells flip flops from Avery’s teaching note, “ Marketing Analysis Toolkit: Breakeven Analysis.” So to calculate BEQ you need to know the fixed costs for your program and the contribution margin per unit. Note that Price per unit – Variable costs per unit is equal to the Contribution margin per unit.

You then reorder the equation to solve for BEQ.

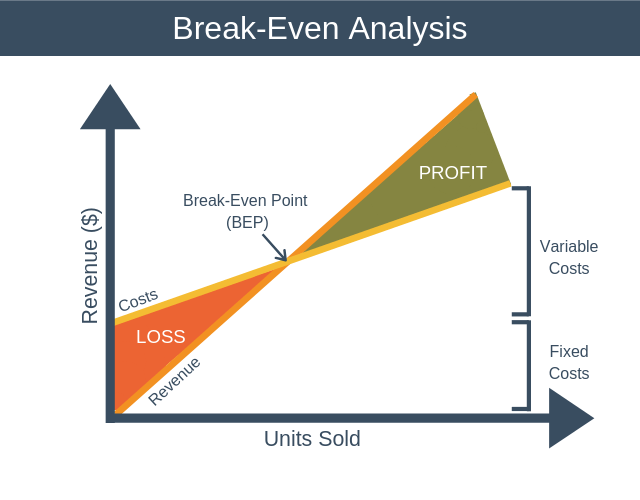

To figure total costs you first multiply the unit quantity sold by the variable costs per unit, then you add the fixed costs. Revenue is the unit quantity sold multiplied by the selling price per unit. The BEQ will be present on both sides of this equation because the number of units sold affects both the revenue the firm earns as well as the costs it must incur to earn it. Then you have to find a unit quantity - your BEQ - that makes both sides of the equation equal. To figure out BEQ, start by setting up an equation where Total Revenue = Total Costs, which will mathematically represent the point at which profit is equal to zero, i.e., where you will break even: “I like breakeven analysis because it is easy to understand and it’s often the simplest way to think about return on investment.” The other forms of ROI often require a more complex understanding of financial concepts such as the firm’s cost of capital or the time value of money. “It’s one of the more popular ways that managers calculate marketing ROI,” says Avery, pointing out that other common ones include calculating the investment payback period, calculating an internal rate of return, and using net present value analysis. If the company sells more than the BEQ then it not only has made its money back but is making additional profit as well. If the company doesn’t sell the equivalent of the BEQ as a result of the investment, then it’s losing money and it won’t recoup its costs. “Breakeven quantity is the number of incremental units that the firm needs to sell to cover the cost of a marketing program or other type of investment,” says Avery.

BREAK EVEN DEFINITION HOW TO

I talked with Jill Avery, a senior lecturer at Harvard Business School and co-author of HBR’s Go To Market Tools, to better understand how to use this important calculation. While the concept may be straightforward, the calculation and the assumptions underlying it are far from simple. Can you justify the price tag of the ad you want to buy or the marketing campaign you’re hoping to launch next quarter? One of the most straightforward ways to answer this question is to perform a breakeven analysis, which will tell you how many incremental units you need to sell to make the money back that you put in. Marketers often have to make the call on whether a certain marketing investment is worth the cost.

0 kommentar(er)

0 kommentar(er)